All Categories

Featured

Table of Contents

Insurance coverage amount chosen will certainly coincide for all protected youngsters and may not surpass the face quantity of the base policy. Problem ages begin at one month via much less than 18 years old. Policy ends up being exchangeable to a whole life policy in between the ages of 22 to 25. A handful of variables affect just how much final expense life insurance you absolutely need.

A total statement of coverage is located only in the plan. There are constraints and conditions pertaining to payment of benefits due to misstatements on the application or when fatality is the result of self-destruction in the very first two plan years.

Long-term life insurance coverage creates money value that can be obtained. The quantity of cash worth readily available will normally depend on the kind of long-term plan purchased, the quantity of protection acquired, the size of time the policy has actually been in pressure and any kind of impressive policy car loans.

Cheap Funeral Cover For Parents

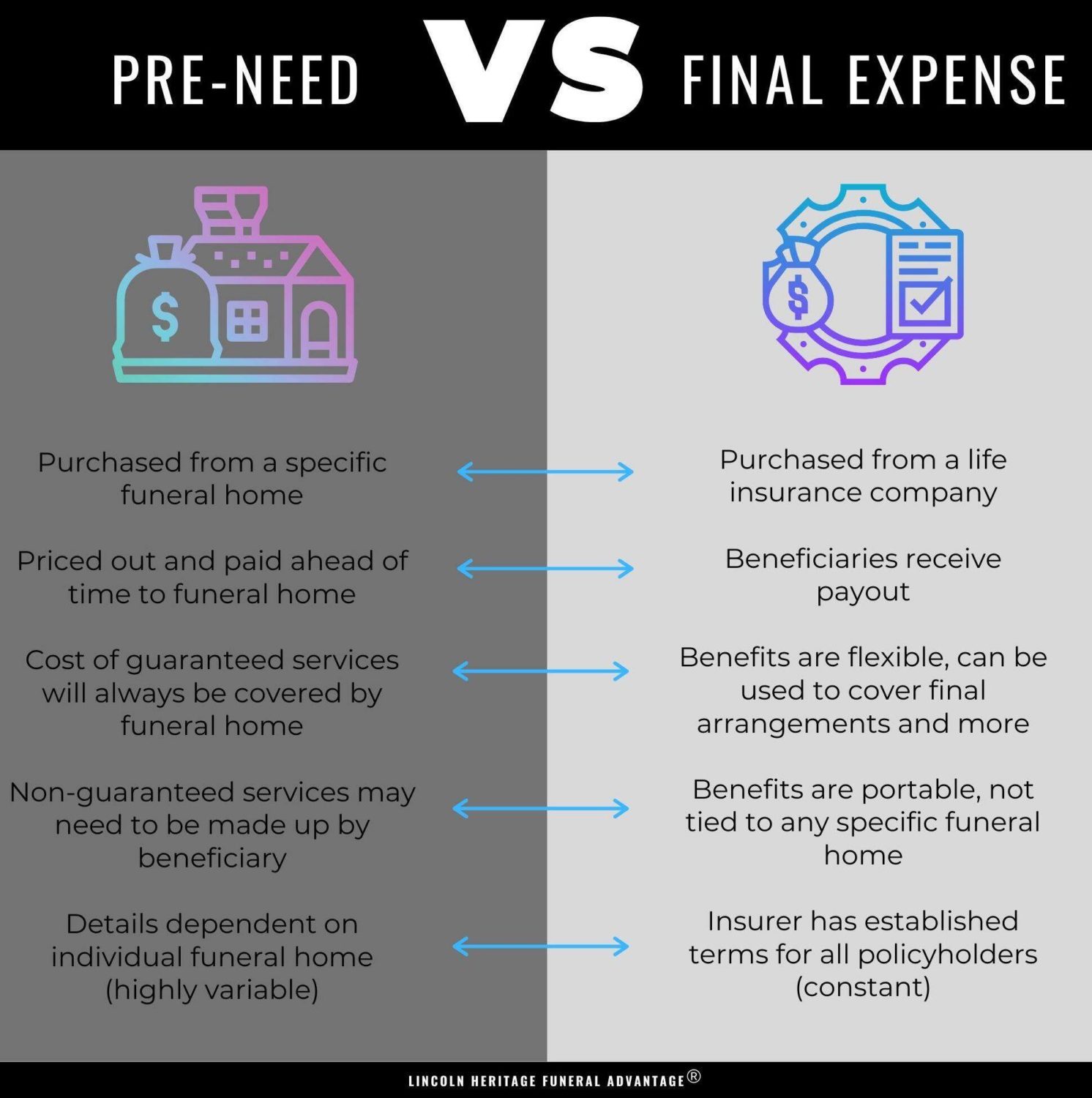

Furthermore, neither State Farm neither its manufacturers give investment recommendations, other than in particular minimal circumstances associating to tax-qualified dealt with annuities and life insurance coverage plans moneying tax-qualified accounts. This policy does not guarantee that its profits will be sufficient to pay for any specific solution or goods at the time of demand or that services or merchandise will be provided by any kind of certain provider.

The ideal way to make certain the plan quantity paid is invested where intended is to call a recipient (and, in some instances, a secondary and tertiary beneficiary) or to position your desires in an enduring will and testimony. It is usually an excellent method to notify key beneficiaries of their expected obligations when a Final Expense Insurance plan is obtained.

Premiums begin at $21 per month * for a $5,000 coverage plan (costs will certainly vary based on concern age, gender, and protection quantity). No clinical evaluation and no health and wellness inquiries are needed, and consumers are assured protection with automatic credentials - is funeral insurance worth it.

To find out more on Living Advantages, visit this site. Coverage under Surefire Problem Whole Life insurance policy can normally be settled within 48 hours of first application. Start an application and purchase a policy on our Surefire Problem Whole Life insurance policy DIY page, or call 800-586-3022 to talk to a certified life insurance coverage representative today. Listed below you will locate some frequently asked inquiries ought to you pick to make an application for Last Expenditure Life Insurance Coverage by yourself. Corebridge Direct certified life insurance policy agents are standing by to respond to any type of additional inquiries you could have regarding the security of your liked ones in the occasion of your passing.

They can be made use of on anything and are made to assist the recipients stay clear of an economic crisis when an enjoyed one passes. Funds are typically utilized to cover funeral expenses, medical expenses, paying off a home loan, auto finances, or perhaps utilized as a nest egg for a new home. If you have sufficient cost savings to cover your end-of-life costs, after that you might not need last expense insurance coverage.

Additionally, if you've been unable to receive bigger life insurance policies as a result of age or clinical problems, a final expense plan might be a budget-friendly alternative that lowers the problem positioned on your household when you pass. Yes. Last cost life insurance policy is not the only means to cover your end-of-life expenses.

Average Final Expense Premium

These normally give greater protection amounts and can shield your household's way of living in addition to cover your last costs. Connected: Entire life insurance policy for seniors.

The application process fasts and very easy, and insurance coverage can be released in days, often also on the day you use. As soon as you have actually been accepted, your insurance coverage begins instantly. Your plan never ever runs out as long as your costs are paid. Last expense plans can build cash money value with time. As soon as the cash money value of your policy is high sufficient, you can withdraw cash money from it, use it to borrow cash, and even pay your costs.

1 Life Funeral Plan

There are a number of costs associated with a death, so having final cost protection is necessary. A few of the essentials covered consist of: Funeral arrangements, including embalming, casket, blossoms, and services Interment costs, including cremation, funeral plot, headstone, and interment Outstanding medical, lawful, or bank card expenses Once the funds have actually been paid to your beneficiary, they can utilize the money any kind of way they want.

Simply make sure you choose someone you can trust to designate the funds appropriately. Dynamic Solutions - final expense insurance market is your resource for all things life insurance policy, from just how it works to the types of plans readily available

This survivor benefit is typically related to end-of-life costs such as medical costs, funeral prices, and more. Choosing a last expenditure insurance alternative is just one of the numerous steps you can require to prepare your family for the future. To aid you better comprehend the ins and outs of this sort of whole life insurance policy policy, allow's take a more detailed check out exactly how last cost insurance functions and the types of policies that might be offered for you.

Not every last cost life insurance policy is the very same. burial insurance for elderly. A prompt or basic final cost insurance plan enables for beneficiaries to receive complete death advantages no matter when or exactly how the insurance holder passed away after the beginning of the insurance coverage plan.

For example, a rated advantage plan might have it to make sure that if the insured passes during the first year of the policy, as much as 40 percent of the advantage will be provided to the beneficiaries. If the insured dies within the 2nd year, up to 80 percent of the benefits will certainly most likely to the recipients.

What Is A Final Expense Policy

A guaranteed issue final expense insurance plan requires a two- to three-year waiting duration prior to being qualified to receive advantages. If the insured specific die before the end of this waiting duration, the beneficiaries will certainly not be eligible to receive the survivor benefit. They might obtain a return of the premiums that have been paid with interest.

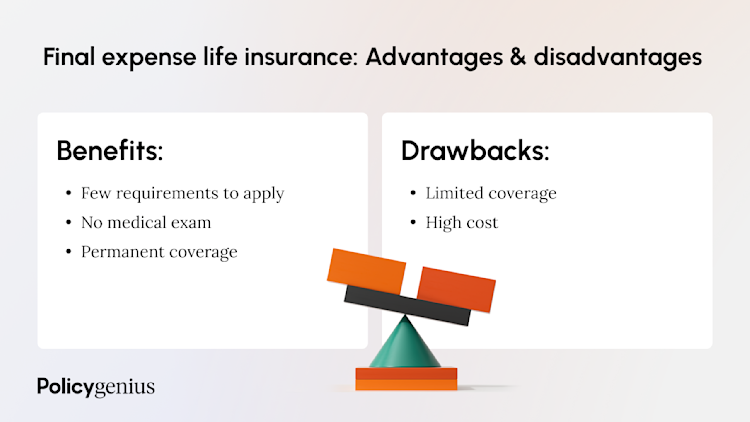

Depending on your health and wellness and your financial resources, some plans might be much better suited for you and your family over the other options. Generally, final expenditure life insurance policy is great for any individual searching for a budget friendly policy that will certainly help cover any type of exceptional equilibriums and funeral costs. The cost of premiums has a tendency to be reduced than traditional insurance coverage, making them fairly cost effective if you are searching for something that will fit a tight budget.

One Life America Final Expense

An instant last expenditure policy is a great alternative for anyone that is not in good health and wellness because recipients are eligible to obtain benefits without a waiting period. A study on the health and case history of the insurance holder may establish just how much the premium on this policy will be and affect the survivor benefit amount.

A person with major health conditions can be rejected various other kinds of life insurance, but an assured issue policy can still give them with the protection they require. Getting ready for end-of-life expenditures is never a delightful discussion to have, however it is one that will help your family members when encountering a tough time.

Insurance Burial Policy

It can be uncomfortable to consider the costs that are left when we die. Failing to prepare in advance for an expense may leave your household owing hundreds of bucks. Oxford Life's Assurance final expense entire life insurance policy policy is an economical method to aid cover funeral expenses and other expenditures left behind.

Latest Posts

Funeral Cover Policy

Final Expense Insurance For Seniors Over 70

Global Burial Insurance